For some professions, it’s all about: “location, location, location.” For online start-ups, you probably want to be in Silicon Valley. If you want to work on the stock market, head to New York City. But for teachers, where you work doesn’t matter, right?

Wrong.

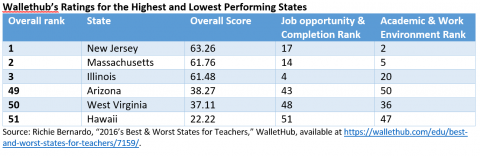

According to WalletHub’s recent analysis, there is significant variation in teacher job quality from state-to-state.

But WalletHub’s rankings shouldn’t be taken at face value. And, as with any aggregate state ranking, the devil is in the details. About 14 percent of their total Job Opportunity & Completion Rank is based on the cost-adjusted “average” teacher pension in each state.

That’s a big problem. Averages can easily distort what’s actually going on.

Evaluating teacher retirement systems based on the average pension is misleading, because the majority of teachers do not even receive a pension. In Washington, D.C., for example, the average teacher pension is extremely high at almost $65,000, but only 29 percent of teachers ever qualify for a pension. So rating D.C.’s pension system on the average benefit of those who remain misrepresents the retirement realities teachers face. Simply put, a state’s average pension value does not provide much useful information about the quality of teachers’ retirement.

There are a couple of ways WalletHub could have evaluated state pension systems more effectively. For example, they could have used a vesting rate. This would grade states on the percentage of teachers that actually qualify for a pension. But even that won’t address other important concerns, such as whether teacher retirement benefits are portable or whether a state’s pension system is financially stable.

In WalletHub’s defense, teacher pensions are complicated. In fact, this points to a larger problem: teachers often lack sufficient information about their retirement. What is the vesting period? Do I qualify for Social Security? What is the retirement age?

The answers to these questions matter.