The economic collapse in the wake of COVID-19 will hurt investment returns, whether those investments are held by individuals in their 401(k) accounts or in public-sector pension plans.

As states grapple with the consequences of a $1 trillion growth in unfunded liabilities, we’re likely to see calls for states to close their defined benefit pension plans and replace them with defined contribution accounts, like 401ks. Pension advocates may respond that the current environment shows exactly why not to take such a move, since the economic collapse presents a stark illustration of what might happen if we shifted all investment risks from state and local governments onto individuals.

But as I write in a new piece for The Omaha World-Herald, there’s another alternative that states should consider. This option, called a “cash balance” plan, should be particularly appealing to teachers. Cash balance plans balance the risks between employees and employers, provide a more portable benefit than traditional pension plans, and help prevent the build-up of unfunded liabilities.

To illustrate this issue, consider the contrast between the retirement benefits Nebraska provides its school employees and its state employees. Teachers and other educators are enrolled in a traditional defined benefit pension system, while state employees hired since 2003 are enrolled in a cash balance plan.

Under Nebraska’s School Employees’ Retirement System, the state has built up an unfunded liability of $1.3 billion. In response, the state has raised contribution rates and introduced new, less generous benefit tiers for workers based on their hire date. Employees must serve for at least five years before qualifying for a pension (called the vesting period). Those hired post-2018 are placed in Tier Four. They must contribute 9.78 percent of their salary and are eligible to retire at age 65 or as early as age 60 if the sum of their age and years of service is more than 85 (called the “rule of 85.”). At that point, they qualify for a pension worth 2 percent times their years of service times the average of their five highest years of salary.

Due to very high early-career turnover rates, only about one-third of new Nebraska educators will qualify for any pension at all, and only about one-in-eight will leave with a pension benefit worth more than their own contributions plus interest.

In contrast, since 2003 Nebraska has enrolled all new state employees in a different type of retirement plan. Commonly known as a cash balance plan, it is legally a defined benefit plan. But rather than conferring benefits via a formula, it guarantees employees a minimum rate of return on their investments. In Nebraska, that figure is 5 percent a year, plus additional interest credits and dividends when investment returns are strong. Employees contribute 4.8 percent of salary, and after vesting at three years, employees receive a state matching contribution equal to 7.49 percent of their salary. Upon reaching retirement age, cash balance plan members can collect a monthly annuity (just like a pension plan) or take their money as a lump-sum.

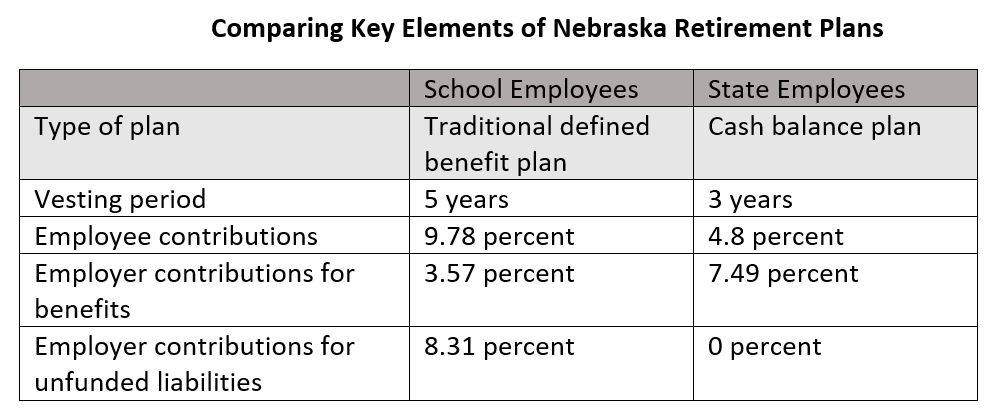

The table below compares the two plans as of today. Compared to state employees, school employees have to wait longer to collect a retirement benefit (five years versus three), pay higher contribution rates (9.78 versus 4.8 percent), and receive less in employer-provided benefits (3.57 percent of salary versus 7.49 percent). Moreover, employers under the school plan are paying an additional 8.31 percent of each member’s salary to pay down the plan’s unfunded liabilities. That money could be going toward salaries or other school services but is instead being siphoned off to pay for the plan’s pension debts.

The teacher plan already has more than $1 billion in unfunded liabilities. If the past recession is any guide, it will likely need to raise contribution rates again and/ or make further benefit cuts.

In contrast, Nebraska's cash balance plan is currently operating a surplus and has mainted a funding ratio of 90 percent or more every year since it began. In the midst of the current economic downturn, the cash balance plan will continue crediting employees with the same 5 percent investment return guarantee. While those of us with 401k plans will watch our investments decline, and teachers will feel the effects of a downturn via their pension benefits, Nebraska state employees can rest easy knowing their investments will continue to grow at the same 5 percent rate.