Teacher pension funds are complicated and can be difficult to understand. They’re not as straightforward as other retirement savings accounts, such as 401ks, nor are they like traditional investments in stocks. In a 401k, for example, the value of the retirement fund is determined by employer and employee contributions, plus the growth of those investments over time.

Defined benefit pension plans, like the ones serving 90 percent of public school teachers, don't work that way.

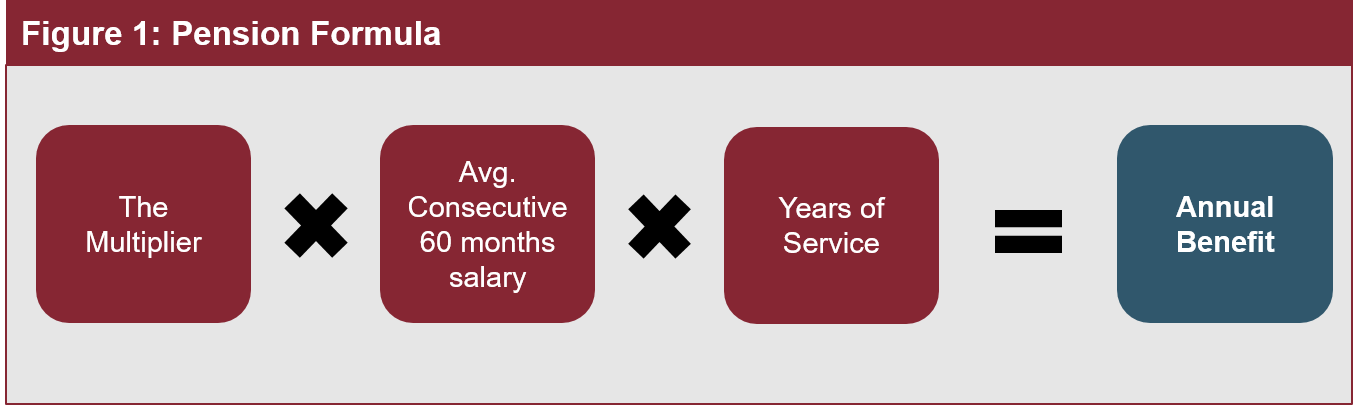

To be sure, teacher pension plans are invested in the market. However, individual teacher contributions and those made on their behalf by the state or school district do not determine the value of the pension. Instead, a teacher's pension wealth is determined by a formula based on her years of experience and final salary.

To further complicate matters, there often are several tiers within a state’s pension fund that provide different levels of benefits based on when a teacher was first hired. And of course, teacher pension funds can vary significantly from state to state.

How Teacher Pensions Work in Arizona

In Arizona, teachers are a part of the Arizona State Retirement System, which includes not only teachers but all state employees. Indeed, the system was established in 1953 and teachers voted to join two years later.

The basic structure of Arizona’s teacher pension is similar to that of other states. The figure below illustrates how a teacher pension is calculated in Arizona. It is important to note, however, that the state assesses an educator’s final salary based on their average salary from the past 5 consecutive years.

Generally, states use a consistent multiplier, for example 2 percent, for all teachers. However, Arizona is unique and applies four different multipliers depending on the teacher's years of service. This approach provides slightly more generous benefits to those teachers who serve the longest. As shown in the table below, for the first 19 years a teacher’s pension benefit will be calculated with a multiplier of 2.1 percent. Once they begin their 20th year teaching, however, the multiplier increases to 2.15 percent.

Table 1: Arizona’s Pension Multiplier

Years of Service | Multiplier |

Less than 20 | 2.1% |

20 to 24.99 | 2.15% |

25 to 29.99 | 2.2% |

More than 30 | 2.3% |

There are a few other features of Arizona’s teacher pension plan that make it unique. First, unlike most states, Arizona does not have a vesting period. This means that educators qualify for a pension regardless of how long they serve. That pension may not be worth all that much, and educators can’t begin to collect it until they hit the state’s retirement ages, but immediate vesting does at least ensure all educators begin to accrue pension benefits immediately.

The state sets specific windows when teachers can retire with full benefits based on age and years of experience. For new teachers just startting out in Arizona, they can retire with their full benefits when they meet the following conditions:

- Age 65;

- Age 62 with at least 10 years of experience

- Age 60 with at least 25 years of experience; and,

- Age 55 with at least 30 years of experience.

Additionally, Arizona allows early retirement at age 50 with at least 5 years of experience, but teachers taking that option have their benefits reduced based on their years of experience and how early they are retiring.

As they work, teachers and their employers must contribute into the plan. Those contribution rates are set by the state legislature and can change year-to-year. In 2017, both the state and the employee contributed 11.34 percent of their salary to the pension fund. This year the rates are the same, but that may not always be the case.

Finally, in Arizona, as with most states, teacher pensions are not portable. This means that if a teacher leaves the state she can’t take her benefits with her, even if she continues working in the teaching profession. As a result, a teacher who moves states might have two pensions, but the sum of those two pensions is likely to be worth less than if she remained in one system for her entire career. In other words, the lack of benefit portability will hurt the long-term retirement savings of any educator who leaves teaching altogether or who crosses state lines to work in another state.

Arizona’s Teacher Pension System Heavily Favors Teachers with More Than 25 Years of Experience

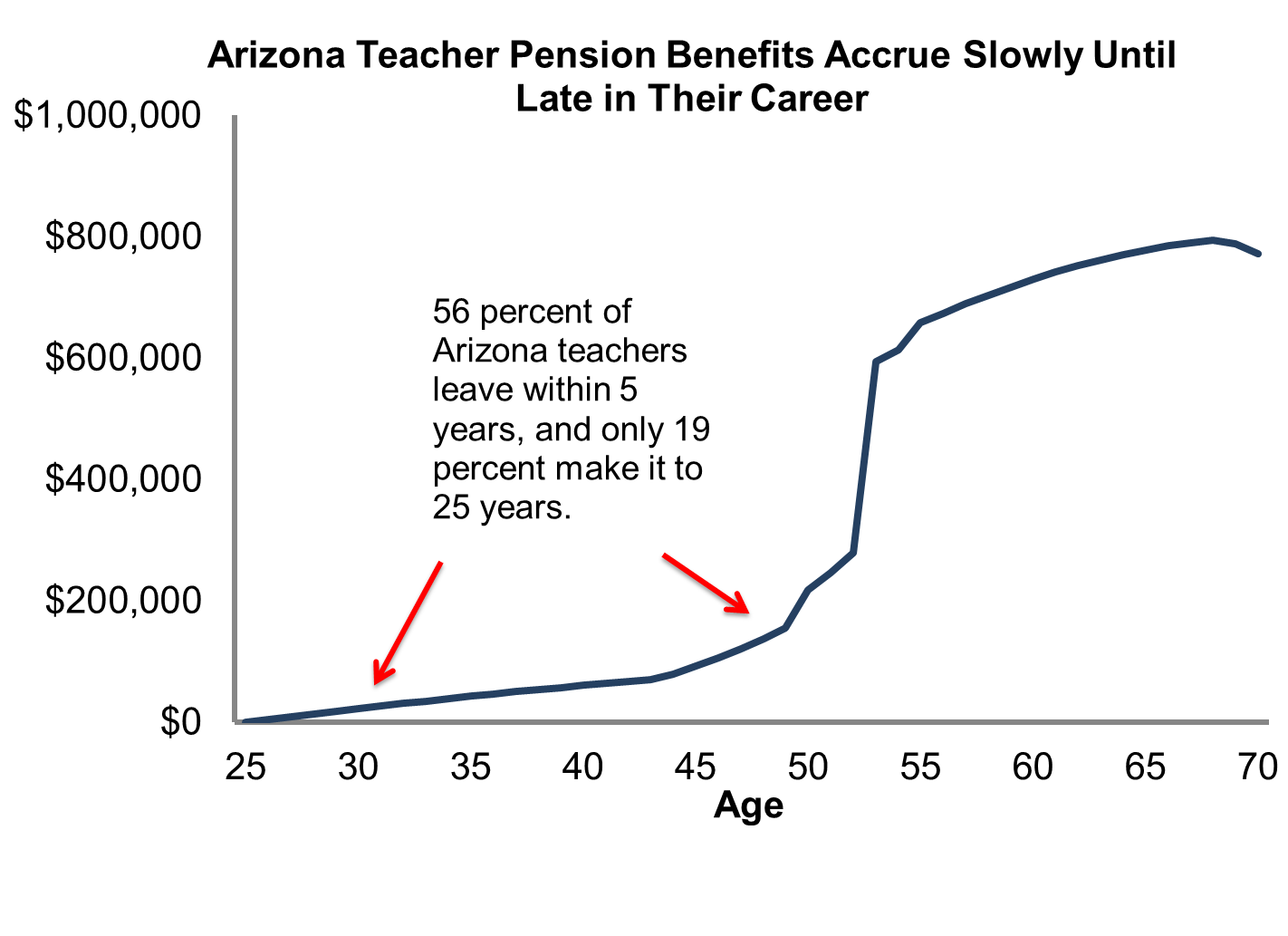

An unfortunate feature of teacher pension systems is that they are severely back-loaded. In other words, benefits accrue extremely slowly and thus educators only earn valuable pensions after decades of service. This structure may work well for teachers who spend their entire career in classrooms in a single state, but it does not work as well for those educators who change jobs or are more mobile.

The graph below illustrates the benefit accrual rate for a typical Arizona teacher who begins teaching at age 25. The first thing to notice is that benefits accrue very slowly until they teach for about 25 years. However, According to the state’s own projections, only about 19 percent of teachers will remain in the profession long enough to reach their 25th year of service. In other words, for most teachers Arizona’s immediate vesting does not translate into a valuable pension benefit.

Figure 2: How Retirement Assets Accumulate in the Arizona State Retirement System

There is a severe mismatch between Arizona’s teacher pension system and the educator workforce in the state. Pensions are great at providing valuable retirement benefits to those who spend their entire career in schools in one state. But the Arizona teacher workforce doesn’t fit that model. As a result, the vast majority of teachers in Arizona will leave their years of service with only meager retirement benefits.

Overall, Arizona’s teacher pension system is a bit more complicated than the typical state plan. But as with most state pension funds, Arizona’s teachers must remain in the profession for nearly three decades to earn a quality retirement benefit. With that in mind, new and current teachers in Arizona should think carefully about their career plans and how they interact with the state's retirement plan. Educators who leave the profession early, even if they qualify for a small pension, will unintentionally do damage do their long-term retirement savings.