Illinois recently passed landmark legislation to reform the state’s pension system. The law includes a number of reforms that reduce pension benefits for retirees and current employees. While the law does not affect Chicago teachers*, Mayor Rahm Emanuel has already voiced a need for similar reform in the Windy City. Union members have protested that position and recently formed a coalition to stop any changes in pension benefits. The Chicago Teachers’ Union recently released a report, titled “The Great Pension Caper”, arguing against pension cuts.

The Chicago Teachers Pension Fund represents one of several retirement systems in the city of Chicago. Other retirement systems include the Chicago Transit Authority Fund, the Cook County Employees’ Pension Fund, the Firemen’s Annuity and Benefit Fund of Chicago, the Policemen’s Annuity and Benefit Fund of Chicago, in addition to several other municipal employee funds. According to the Commission on Government Forecasting and Accountability, the Chicago Teachers Pension Fund has a 53.9 percent funded ratio. But, even as the funded ratio dropped from 78 percent in 2006 to 54 percent funded in 2012, the average teacher retirement benefit increased from $37,241 in 2006 to $46,440 in 2012. Chicago is paying more in pensions benefits while its funding ratio is dropping.

In order to be eligible for a pension, teachers must meet a minimum number of years of service or a vesting requirement before they receive rights to a pension. In the Chicago Public Schools, teachers employed before January 1, 2011 are required to work five years before becoming eligible for a minimum pension. These are called Tier 1 employees. Later the city increased the vesting period such that teachers employed on or after January 1, 2011 must serve 10 years before being eligible for a pension. These are called Tier 2 employees. In addition to changes in the vesting requirement, the retirement age increased for Tier 2 teachers. Where Tier 1 teachers can retire with full pension benefits at age 60 with at least 20 years of service (or age 62 with at least 5 years of service or age 55 with at least 33.95 years of service), Tier 2 teachers must wait to retire until age 67 with at least 10 years of service according to the Chicago Teachers' Pension Fund.

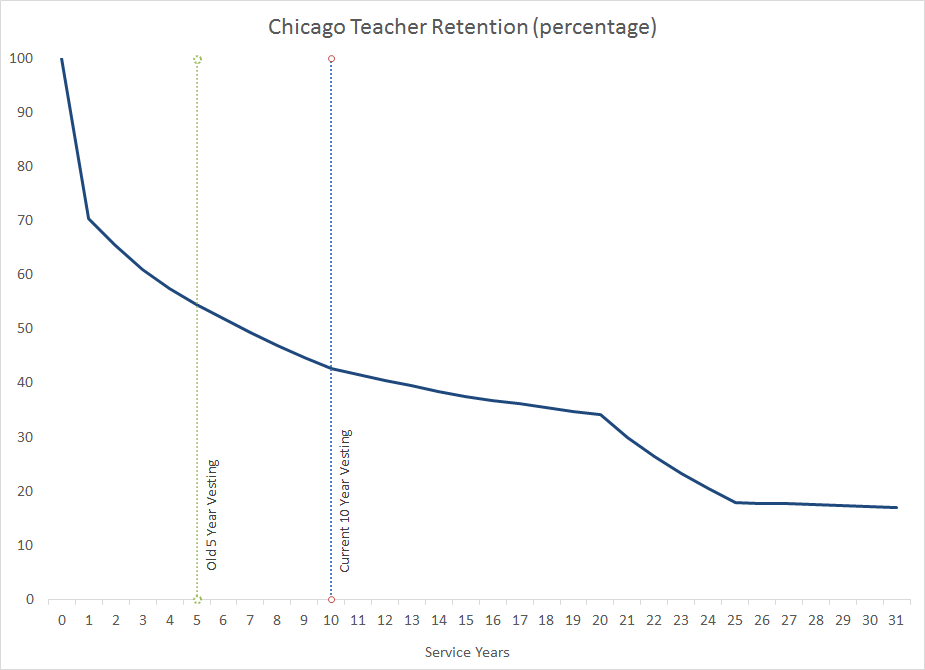

To better understand Chicago’s situation in relation to its teachers, take a look at some data from the city’s comprehensive financial report. The chart below shows the city’s assumed teacher retention rates for 25-year-old female teachers.

Source: Chicago Teachers’ Pension Fund Comprehensive Annual Financial Report 2012As shown in the graph, 45 percent of teachers leave after five years and 57 percent leave after 10 years. For Tier 1 teachers, the city assumes 55 percent will stay for five years and qualify for a minimum pension. For Tier 2 teachers, only 43 percent will stay the full 10 years and qualify for a pension.

Because Illinois is one of a cluster of states that excludes teachers from receiving Social Security, Chicago Public Schools teachers do not receive Social Security benefits. In other words, a teacher hired after 2011 could work up to nine years in Chicago without any form of retirement benefit, pension or Social Security. These teachers have evaded the attention of the media as well as lawmakers, and instead quietly leave without any employer-provided retirement savings.

The retention percentages drop even further as time progresses and few teachers reach eligibility for full retirement benefits. The percentage of teachers who teach beyond 25 years plateaus at 17 percent. Under Tier 1 requirements, a teacher beginning at age 25 with a total service of 34 years can retire at age 58 (Tier 1 requires a teacher retiring at age 55 to have a rather unusual retirement requirement of 33.95 years of service to receive unreduced pension benefits). This means that approximately 83 percent of teachers who began their careers at age 25 under Tier 1 requirements will not stay in the profession long enough to reach eligibility for full pension benefits. The Tier 2 changes increase the retirement age to age 67 but with a minimum of ten years of service. This creates an odd set of incentive for teachers, making it more difficult for early career teachers to receive a pension while granting full pension benefits for later career changers. A teacher beginning at age 25 cannot retire any earlier than age 67 and therefore would need to serve a minimum of 43 years to reach eligibility, otherwise she will face reductions in her pension. On the other hand, a teacher who begins teaching at age 58 could presumably teach for 10 years and retire with full benefits at age 67.

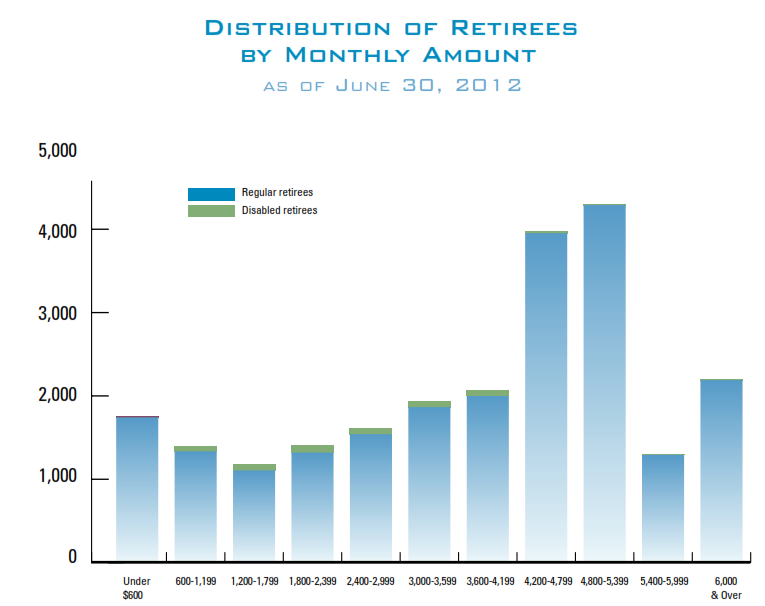

The next graph shows the distribution of retirement benefits for teachers who qualify for a pension.

Source: Chicago Teachers’ Pension Fund Comprehensive Annual Financial Report 2012

As shown in the graph, the most frequent or common retirement benefit is $4,800-5,399 per month or $57,600-64788 a year. A minority of retirees receive monthly benefits of over $6,000 a month or $72,000 a year (some receiving over $100,000). Currently there are 36,926 retirees and beneficiaries who receive a combined total of $93,006,741 per month in benefits from the Chicago Teachers’ Fund. Multiply this amount over the course of a year, and this equates to over a billion dollars a year ($1,116,080,892). Not only are retirement benefits back-loaded such that only a small percentage of teachers benefit, these benefits come at an expensive price tag.

Rather than promoting a system where a small percentage of teachers receive the majority of retirement wealth and the other half nothing, Chicago can use this time of unrest to carefully consider its options for sustainable and equitable retirement reform.

*Note on January 7, 2014, Governor Pat Quinn signed into legislation to stabilize the pension liabilities for the Park Employees and Retirement Board Employees’ Annuity and Benefit Fund. The law affects employees of the Chicago Park District, and includes provisions to increase the retirement age and cut post-retirement benefits.