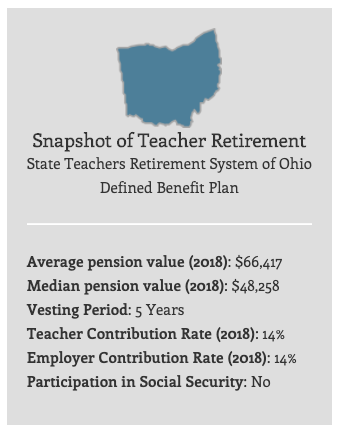

Snapshot of Teacher Retirement

State Teachers Retirement System of Ohio

Defined Benefit Plan

Average pension value (2018): $66,417

Median pension value (2018): $48,258

Vesting Period: 5 Years

Teacher Contribution Rate (2018): 14%

Employer Contribution Rate (2018): 14%

Participation in Social Security: No

How Does Teacher Retirement Work in Ohio?

In Ohio, teachers are a part of the State Teachers Retirement System of Ohio. The system was established in 1920 and is the largest public retirement system in the state.

But unlike most states, new teachers in Ohio have a choice about their retirement plan. New teachers have 180 days from their first day of paid service to select from three possible plans: Defined Benefit Plan, Defined Contribution Plan, or the Combined Plan. If teachers do not make a selection within 180 days, they are automatically enrolled in the Defined Benefit Plan.

Ohio's DB plan and its Combination plan include a pension that is structured similarly to that of other states. Unlike other retirement funds, a teacher’s contributions and those made on their behalf by the state or school district do not determine the value of the pension at retirement. Although those contributions are invested in the market, and often managed by private equity and hedge funds, a teacher’s pension wealth is not derived from the returns on those investments. Instead, it is determined by a formula based on their years of experience and final salary.

Finally, most states, including Ohio, have adopted multiple benefit tiers for teachers depending on when they were hired. Ohio's benefit tiers can be found here.

How is Ohio's Defined Benefit Plan Calculated?

Pension wealth is derived from a formula. The figure below illustrates how a teacher's pension is calculated in Ohio's Defined Benefit Plan. It is important to note, however, that the state assesses an educator’s final salary based on the average of their 5 highest years of salary. For example, a teacher who works for 25 years with a final average salary of $70,000 would be eligible for an annual pension benefit worth 55 percent of their final salary.

Calculating Pension Wealth in Ohio's DB Plan

| 2.2% Multiplier | X | Avg. 5 highest years of salary | X | Years of service |

Who Qualifies for a Pension under Ohio's DB Plan?

Like most states, teachers need to serve a number of years before qualifying for a pension. Ohio has a 5 year vesting period. While educators qualify for a pension after 5 years of service, the pension may not be worth all that much. Moreover, educators can’t begin to collect it until they hit the state’s retirement age. The state sets specific windows when teachers can retire with benefits based on age and years of experience. For new teachers starting out in Ohio, they can retire with their full benefits when they reach 65 years of age and have accrued at least 5 years of service, or when they reach 60 years of age and have accrued at least 35 years of service.

Additionally, Ohio allows early retirement for teachers at any age once they have accrued at least 33 years of service, or at age 60 once they have accrued at least 5 years of service. However, teachers taking that option will have their benefits reduced based on their years of experience and how early they are retiring.

How Much Does Ohio's DB Plan Cost?

As they work, teachers and their employers must contribute into the plan. Those contribution rates are set by the state legislature and can change year-to-year. Typically a teacher's full contribution goes to pay for their benefits. However, in Ohio teachers also pay a portion of the state's unfunded liability. As a result, 10.91 of a teacher's 14 percent contribution is for benefits, while the remaining 3.01 percent goes toward paying down the fund's debt. The state contributes 14 percent of salary to the fund, all of which is to pay down unfunded liabilities.

An educator participating in Ohio's DB plan who leaves the classroom or moves to another state to teach cannot take their pension with them. Even if they have vested into the system, these teachers can either withdraw their funds at a penalty or leave the funds in the pension and collect a modest pension when they retire. Unlike other retirement funds, one state's pension cannot be combined with another's.

How Does Ohio's DC Plan Work?

Teachers who elect to participate in Ohio's DC plan contribute 14 percent of their salary annually to their investment account. Teachers' employer contributes an additional 9.53 percent of salary to the fund yearly. In total, 23.53 percent of a teacher's salary goes into their investment account annually. The wealth of this plan is based on their contributions and the interest they accrue. Teachers are immediately vested for their own contributions. They vest for their employer's contributions gradually. Each year a teacher is eligible for 20 percent of their employer's contributions. They are fully vested after 5 years. This plan is fully portable. This means a teacher can take their contributions with them wihtout penalty if they leave teaching or move to another state. They are also able to take their employer contributions depending on their vesting status.

How Does Ohio's Combination Plan Work?

Ohio's Combination plan includes elements of both a DB pension plan and a DC plan. As with the other plans, a teacher contributes 14 percent of their salary to their retirement fund each year. However, under this plan 12 percent is allocated to a DC investment fund and 2 percent is allocated to a DB fund. A teacher's employer only contributes to the DB portion of the plan. The employer contribution rate is actuarially determined yearly. A teacher's pension wealth for the DB component follows a similar structure to the DB plan detailed above, but there is a slight difference. The multiplier is reduced to 1 percent. In other words, a teacher who serves for 25 years under this Combination Plan would be eligible for an annual pension benefit 25 percent of their final average salary. But keep in mind, this is only part of the overall retirement wealth generated under this plan. The same vesting rules for the DC and DB portions of this plan apply. Teachers vest immediately for their own contributions to the DC plan, and vest gradually, 20 percent each year, for their employer's DC contributions. The DB plan vests after 5 years. But unlike the DC contributions, the DB plan is not portable.

Glossary of Financial Terms

Vesting period: The number of years a teacher must teach before becoming eligible to receive a pension. Although the length of vesting periods vary by state, 5 years is typical. In every state, a teacher who leaves prior to vesting is eligible to withdraw his or her own contributions, sometimes with interest, but few states allow those employees to collect any portion of the employer contributions made on their behalf.

Employee contribution: The percent of a teacher’s salary that he or she pays annually to the pension fund.

Employer contribution: The percent of a teacher’s salary that the state, school district, or a combination of the two pays annually to the pension fund.

Normal cost: The annual cost of retirement benefits as a percentage of teacher salary. This excludes any debt cost.

Amortization cost: The annual cost of a pension fund’s contribution toward any unfunded liabilities. This can also be thought of as the debt cost of the pension fund.

https://www.teacherpensions.org/state/ohio