Pension reform isn’t black and white. Although stakeholders often frame the debate as generous pensions versus stingy 401(k) plans, in reality the options are far more complex. As states consider how to reform their public sector pension plans, it’s important to understand the grey area between the two extremes.

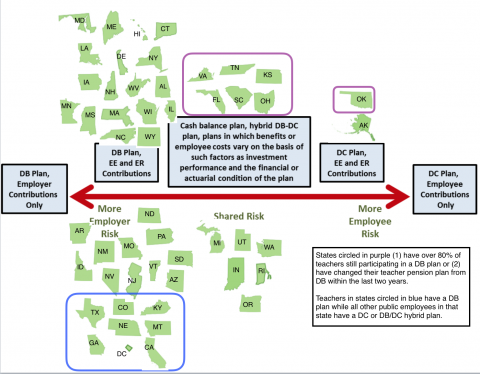

In reality, there’s a wide spectrum of retirement plan options that could meet the needs of workers and employers. The continuum below, originally created by the National Association of State Retirement Administrators (NASRA), presents retirement plan types by employee and employer risk. We took NASRA’s spectrum chart and overlaid images representing which type of plan teachers are given in each state.

Over time, states have been shifting their public-sector pension plans from the far left-hand side, where the state took all the risk, closer to the center of the continuum, where the risk is spread more evenly between the employee and the employer. No state has put all of the burden of saving for retirement on workers alone. Plans that fall in the middle of the spectrum allow workers to move between professions with ease, while also giving employers greater predictability over future retirement costs. The shift toward the middle has been a good thing for public sector workers and for states. However, it isn’t happening at the same rate for all types of public employees.

When states are placed on the continuum based on their teacher plan type, it’s evident that a majority of states still enroll teachers in a traditional defined benefit pension plan. In eight states, those circled in blue, other groups of public employees are given more portable retirement plans, but teachers aren't. Teachers in states like Texas or California are enrolled in back-loaded defined benefit pension plans, while public-sector employees in those states have access to more portable defined contribution (DC) plans or a hybrid plan.

This situation is not a good deal for teachers. In fact, teachers have the least portable, most back-loaded retirement plans of any group of public-sector workers. This means that, when compared to their peers in other public-sector jobs, teachers have to work more years to earn decent retirement benefits. As Chad Aldeman and Richard Johnson point out, about three-quarters of teachers won’t ever reach the point in their teaching career where their promised future pension is worth more than what they themselves contributed. These teachers would be better off in more portable retirement plans.

There is good news, however, which is that the very long-term trend points in a positive direction. In the states circled in purple, new teachers are now receiving a DC or hybrid plan. This shift is a step in the right direction, but it will take time to show meaningful effects. Focusing on new teachers alone doesn't take away any benefits from anyone who might be counting on them, and it avoids political and legal hurdles that would be required to change benefits for existing workers. Still, the change will take time, and it won't address long-standing funding issues.

We’re in the midst of a slow shift away from back-loaded teacher pension plans. It may take a while, but there’s hope that state policymakers are recognizing there are better options that would provide all teachers sustainable and secure retirement benefits.