Florida offers its teachers a choice. When they begin working in Florida schools, they can choose to join the state's traditional defined benefit (DB) pension plan, or they can enroll in a portable defined contribution (DC) plan instead. The state has an entire website devoted to helping teachers decide which plan is best for them given their age, how long they plan to stay, and how comfortable they are investing money.

At first glance, Florida seems neutral about which option teachers choose. When I took the quiz to identify which plan would be better for me, it recommended the portable DC plan and reassured me that there were a range of investing options, even for people who weren't that confident in their investing abilities. Another state document has a nifty chart estimating which teachers would be better off in which plan, depending on their starting age and how long they planned to stay. It looks like this:

The state's own estimates suggest that anyone who starts teaching in Florida under the age of 45 would be better off in the portable "Investment Plan." Even for people who begin teaching later in life, they would benefit from the DB Pension Plan only if they stayed more than 8 but less than 23 years. So, Florida is essentially telling teachers that there's only a small sliver of teachers for whom the DB Pension Plan would be a better option.

Another document on the Florida Retirement System site includes a footnote that specifically warns teachers that, "According to FRS historical statistics, less than 20% of newly hired employees and 50% of those with over 10 years of service actually stay a full career in FRS employment, given today's mobile society."

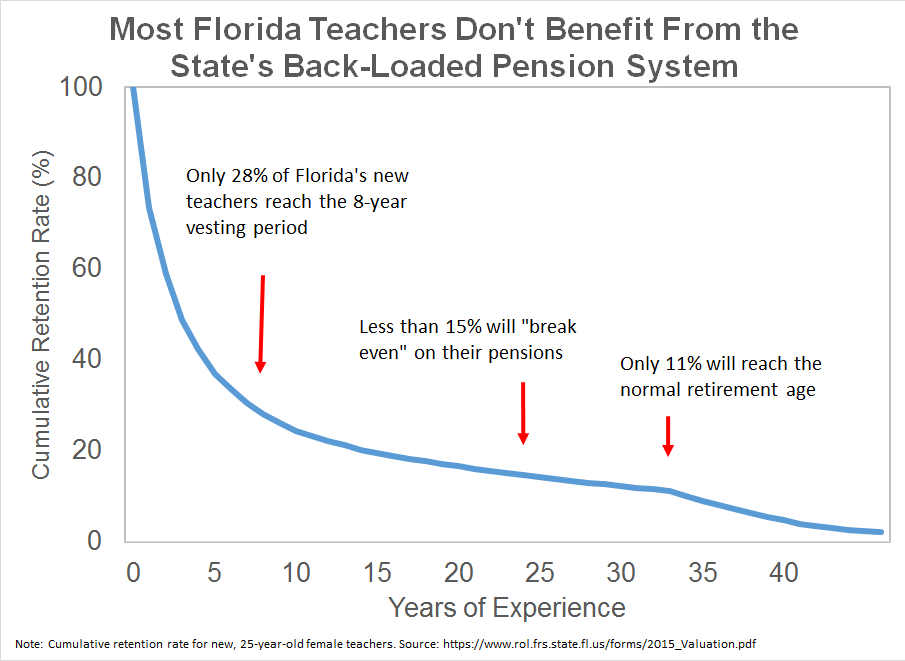

Indeed, this lines up with my own research on Florida's DB plan. Only about one-quarter of new Florida teachers remain in the pension plan for the eight years it takes to qualify for any pension plan at all. A Florida teacher must teach continuously for 24 years before finally qualifying for a pension worth more than her own contributions plus interest. And only about one-in-ten stick around long enough to reach the state's normal retirement age. In short, Florida's defined benefit pension system doesn't work well for the vast majority of its teachers.

Why, then, does Florida default all of its teachers into the defined benefit Pension Plan? (Note: See update below. Florida has since changed its default option.) If teachers do not proactively enroll in a retirement plan within their first five months on the job--a time when many first-year teachers are more worried about the demands of their new job--the state automatically enrolls them in the Pension Plan. To put it another way, Florida defaults all of its rookie teachers into a retirement plan that, as the plan itself acknowledges, is probably not right for most of them.

Now, Florida deserves credit for offering its teachers a choice at all. Alaska is the only state that automatically enrolls all teachers in a portable retirement plan, but five other states in addition to Florida--Michigan, Ohio, South Carolina, Utah, Washington--provide teachers a choice. The rest automatically place all of their teachers into back-loaded defined benefit plans.

But Florida is unlikely to see substantial enrollment changes until it shifts its default. Defaults can be powerful "nudges" that encourage people into behaviors they may not otherwise proactively choose. When companies have switched their retirement plans to automatic participation (with optional opt-outs), they have seen enormous enrollment gains, even though the choices remain the same. These patterns also apply to things like contribution rates and investment choices.

Florida should be applying those lessons to help nudge teachers into better decisions. A bill currently making its way through the state legislature would do just that. It would still give Florida teachers a choice over their retirement plan, but it would set the more portable option as the default. Rookie teachers may not have the time or the wherewhithal to think about their retirement plan, but the state should nonetheless help them make smart decisions.

In the summer of 2017, Florida passed legislation to shift the default option to the portable defined contribution plan, following the recommendations in this post. The new rule applies to all Florida teachers hired after January 1, 2018. For more information, see here.