Change isn’t easy, and the large-scale shift from defined benefit pension plans to 401k-style plans has had its own bumps and missteps. A new report from the Center for Retirement Research at Boston College (CRR) helps document how that transition is going.

The paper looks at retirement wealth of households headed by 51-56 year-olds from the period 1992 to 2010. Before digging into their findings, it's worth noting that 2010 was a difficult year for savers. As a country, we were still coming out of one of the worst recessions ever; unemployment was high, and some employers cut their retirement contributions. Still, the findings here suggest that the transition from DB to DC plans has been turbulent but is not leaving workers materially worse off than they were before.

Here are some takeaways:

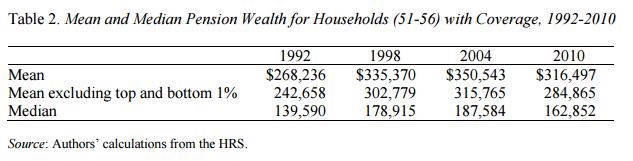

- In inflation-adjusted dollars, retirement savings in 2010 were lower on average than in 1998 and 2004, but they were higher in 2010 than in 1992. The median values (see table below) are especially pertinent, because they show that the overall increases aren’t just being skewed by high-income workers.

- Another way to look at retirement savings is to consider it against income earned while working. Called the "replacement rate," the numbers haven't changed considerably here either. Although incomes rose over this time period, replacement rates were about the same in 2010 as they were in 1992.

These findings are in line with what we’d expect through this transition. The transition away from DB plans was and will not be without some bumps, but DC plans are improving over time, including for low-income and low-education workers. This includes establishing 401(k) plans with auto-enrollment and auto-escalation of default contribution rates, as well as expanding coverage options to individuals without an employer-provided plan. And while some may argue that those without a college degree were better served by a defined benefit plan, data out of the Social Security Association says otherwise.

As careers spent with a single employer become more and more rare, our changing workforce needs retirement plans that can move with them. The transition to portable DC plans hasn’t always been pretty, but those plans are improving over time and expanding to provide workers with sufficient retirement benefits.